The Philadelphia-based company provides returns management software for e-commerce brands and retailers, bringing together technology, including customer relationship management, third-party logistics, inventory management and shipping all together under one umbrella. Users can plug in ReturnLogic’s APIs and access data they can use to make product, process, manufacturing, and procurement changes to improve their bottom line and satisfy customers.

Company founder and CEO Peter Sobotta founded ReturnLogic in 2015 after a long career in reverse logistics. He started paying attention to the new generation of modern e-commerce companies showing up over the past five years. What he noticed was that they had “relentless focus on data and lifetime value, but they simply couldn’t get that,” he said.

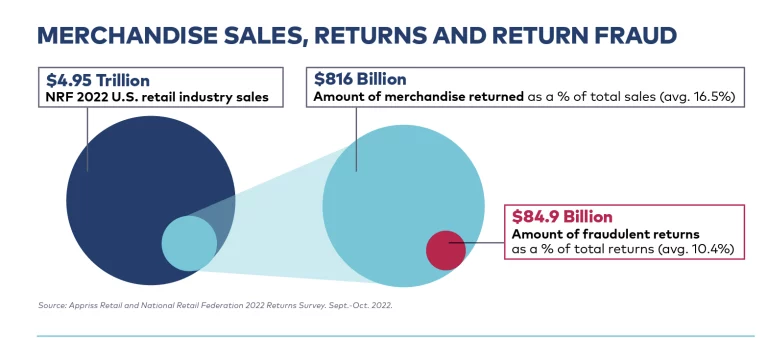

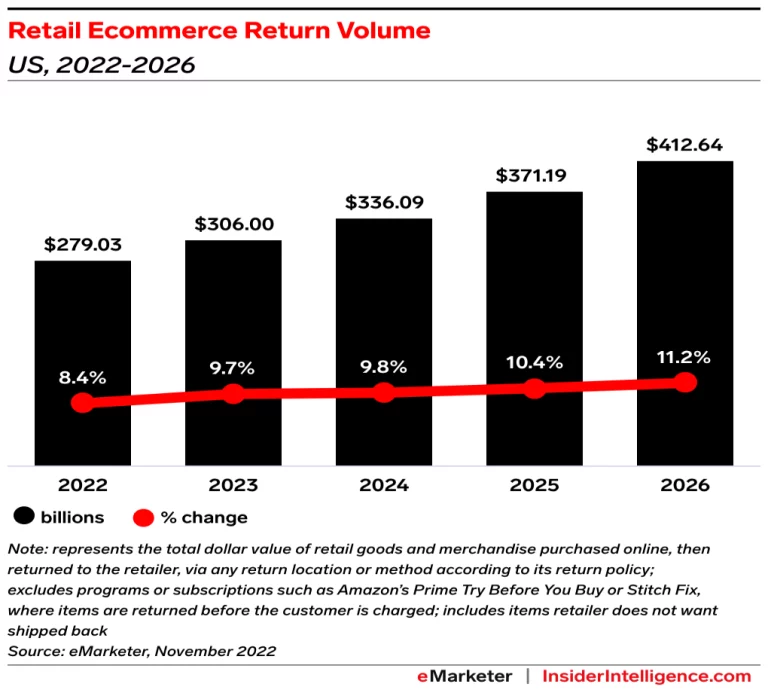

“We saw a nice surge from COVID, everyone did, the tsunami wave hit,” Sobotta added. “The trends we’re seeing right now are retailers are taking returns much more seriously. Because when it comes to investment, dollar for dollar, if you have a place to park money right now and you’re trying to trim costs, but you have a 30% to 40% return rate like most apparel companies do, investing $1 in returns goes straight to the bottom line.”

In the past seven years, ReturnLogic has processed over a half billion returns and grown to serve hundreds of online brands and retailers, including Groove Life, EchelonFit, Oofos, Decathalon, Dossier and The Sak. It also handles third-party warranty returns for large retailers, including Amazon, Walmart and Best Buy.

CGI and 3D Product Imagery Enter the Ecommerce Industry

coresight.com

CGI and 3D Product Imagery Enter the Ecommerce Industry

coresight.com