How to Increase Customer Lifetime Value with Returns Data in Ecommerce

Can ecommerce returns data help you determine what a customer is worth?

Up to a third of all e-commerce purchases will result in a return. That means about 30% of your sales are likely to exit the company as refunds or exchanges. Therefore, considering e-commerce return data when calculating the value of a customer informs the profit you can expect, allows you to allocate marketing spend to acquire a new customer, and helps you design campaigns to win back customers who make a return.

Table of Contents:

- Defining Churn in E-commerce is Hard

- Want to Improve CLV? Stop Looking At It

- Measure What Matters: What a Customer is Likely to Spend

- Focus Your Retention Marketing to Drive Repurchases

- How Returns Impact a Customer’s Expected Monetary Contribution

- Maximize Customer Lifetime Value: The First Purchase is Just the Beginning

In a retail setting, calculating Customer Lifetime Value (CLV) isn’t simple.

Shopify defines CLV as “profit associated with a particular customer relationship, which should guide how much you’re willing to invest to maintain that relationship.”

As this explanation suggests, investments in e-commerce retention marketing tactics are shaped by the subsequent value a retailer can anticipate from existing consumers.

But how do you know how much money you can count on from each customer?

Unfortunately, determining a customer’s worth in an e-commerce environment is easier said than done.

Defining Churn in E-commerce is Hard

As statistician George E.P. Box put it, “All models are wrong, but some are useful”. And similarly, any estimation of the value of a customer will be wrong. Each comes with its set of assumptions and expectations.

Customer churn can’t be definitively measured in non-contractual settings like retail. Popular subscription companies like Netflix, Spotify, and Dollar Shave Club will have an easier time calculating what monetary contribution they can expect from existing customers since they can reasonably forecast payments and easily observe churn.

But for the e-commerce retailer, customer churn greatly complicates projections for future spending of current customers. And more straightforward historical metrics ignore any future activity, essentially assuming all current customers are done buying.

CLV shapes your retention strategies, but retention partly determines CLV.

The predicted lifetime value of a customer isn’t a hard and fast metric.

It’s a pliant one that relies on predictive elements, such as churn, which can be deceiving in a retail environment.

To use an analogy, you don’t lose weight by obsessing over the number on the scale. You lose weight by focusing on the inputs of diet and the outputs of exercise. By targeting these areas, the number on the scale will improve over time.

Want to Improve CLV? Stop Looking At It

So, while it may seem intuitive, CLV isn’t ideal for evaluating Customer Acquisition Costs (CAC).

In fact, weighing the average value retained from a customer against CAC may be a misleading practice since it ignores the costs associated with brand building, service, and – as Shopify stated – maintaining that relationship.

The simplest benchmark of customer value is the average value of a purchase. This benchmark is also the most punitive approach to measuring the financial impact of customer acquisition as it assumes that people buy once – or that acquisition costs must apply to each subsequent order.

However, given high costs to acquire a customer, cost of goods sold, overhead, shipping fees, and the potential for returned products, the actual profit a retailer retains from a first purchase may be slim, if any.

It would also be misleading to use the monetary contribution of long-time purchasers. Looking at the value customers contribute over time paints a better picture of what they can spend, but not necessarily what they will spend.

Measure What Matters: What a Customer is Likely to Spend

To most accurately understand what we can afford to spend on customer acquisition, we must understand what a new customer is likely to spend with a retailer.

Knowing this, retailers can invest smarter by balancing acquisition and retention efforts to maximize profits. Ultimately, both acquisition and retention must work in unison to grow a loyal, active customer base.

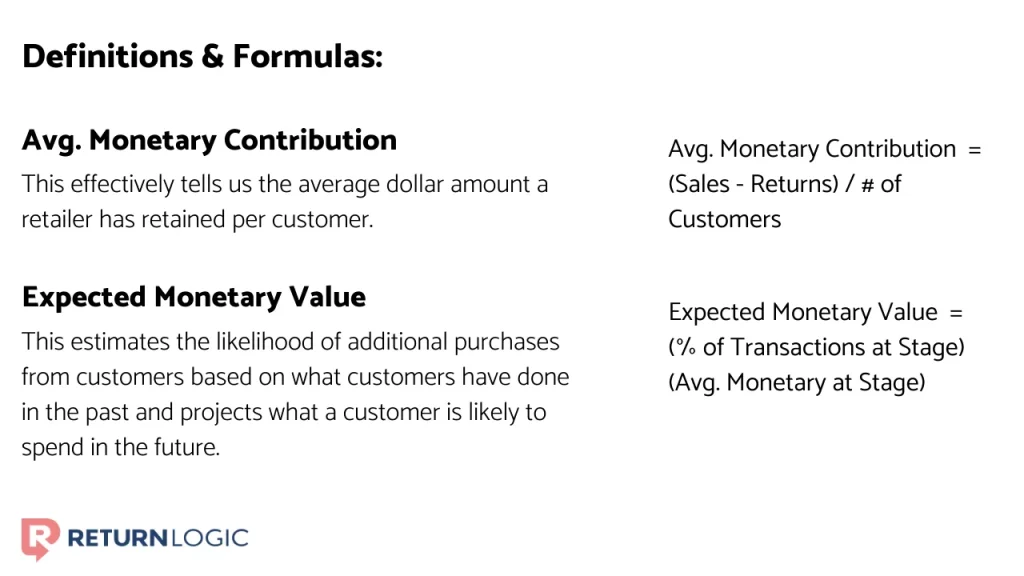

So how then can we estimate the value of a new customer? We could look at the average monetary contribution.

This metric effectively tells us the average dollar amount a retailer retains per customer. It assesses the value customers have brought to a company but doesn’t incorporate potential future spend for current customers.

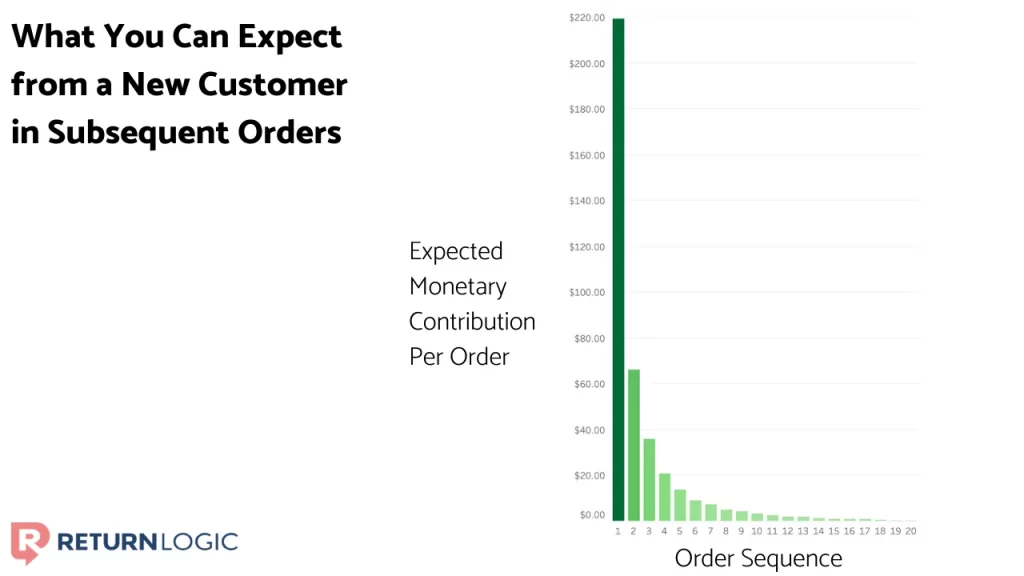

Instead, we can estimate the expected monetary value of a new customer by observing how many transactions occurred at each stage in the purchase sequence and scaling this to approximate the percentage of new customers that’ll reach any given stage in the customer journey.

We can multiply this by the expected monetary value of an order at each stage to approximate the value that a customer is likely to contribute along the purchase sequence.

We see that the lion’s share of the expected customer value comes from the first purchase, confirming that we can never take additional purchases for granted.

This method will not anticipate all future activity but estimates the likelihood of additional purchases from customers based on what customers have done in the past.

The most significant benefit of this approach is how it extends beyond simply what has happened without relying on any rigid assumption of churn.

Instead, it incorporates what is likely to happen, given what has already happened. It’s an intuitive metric that’ll evolve with the retailer as more transactions occur and more data gets implemented.

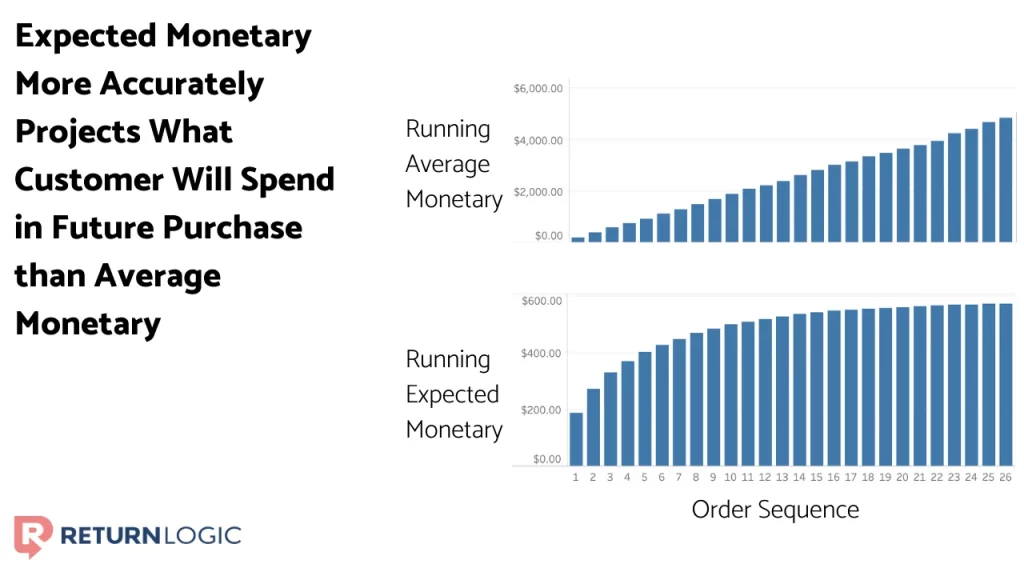

We can then make a rolling sum of expected monetary contributions to estimate the total expected value of any stage of the customer journey.

Even more telling is when we compare what we expect to have received with what we actually received from each purchase.

While this retailer has retained roughly $1,893 per customer by their 10th purchase, they can only expect to receive around $560 by then since only 7% of even the longest-existing buyers have continued to a 10th purchase.

A 10th purchase seems almost unattainable to begin with. But even at the 3rd purchase, the average customer monetary value of $582 far exceeds the expected contribution of $327.

Retailers retain more money from multi-purchase consumers, but not all buyers make multiple orders. In fact, the majority haven’t. So, driving repeat purchases is critical to boosting profit.

Where to Focus Your Retention Marketing to Drive Repurchases

Most retailers must make difficult tradeoffs when allocating marketing spend, with high costs of marketing and constant pressure to expand. In this environment, most retailers choose to invest in top-of-the-funnel marketing activities.

Retention marketing can be an easy victim in this process. Once a prospective customer makes a purchase, it can be tempting to count on them to repeat their behavior and rely on e-commerce email marketing to keep them engaged.

We’ve heard from fashion apparel retailers that customers are not likely to buy in the time immediately following a purchase, so there’s no need to spend more money to reengage them quickly.

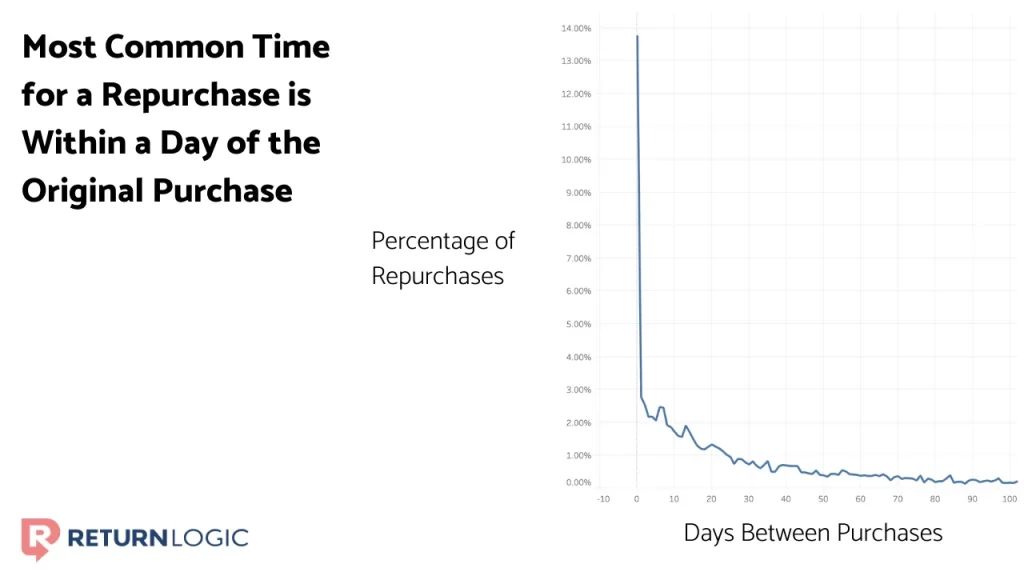

But the data tells a different story. The graph below shows one of our client’s percentages of repurchase that occurred on any number of days since the previous purchase.

These figures demonstrate that the most common time for a repurchase is actually within a day of the original purchase.

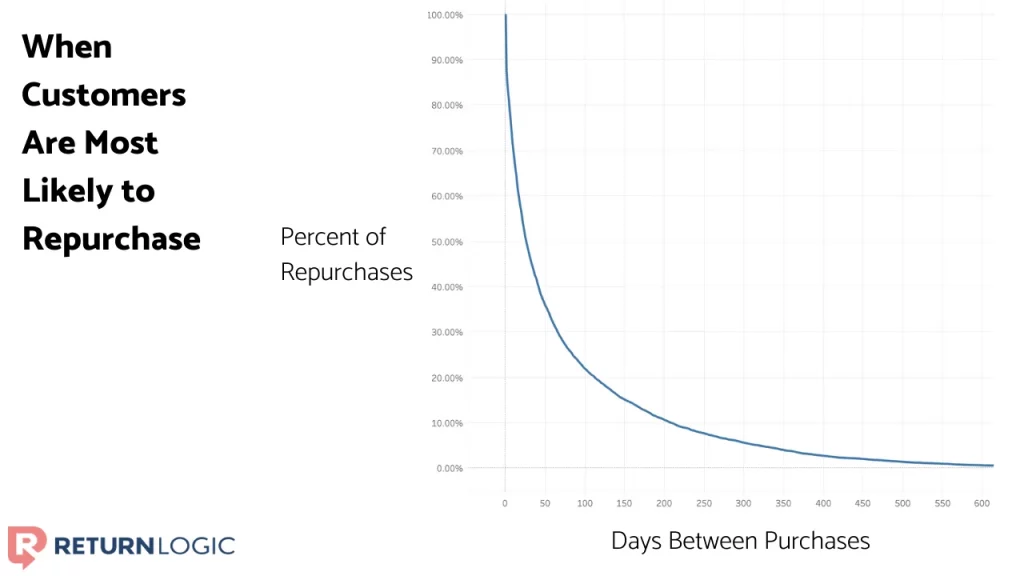

Shown below is the percentage of repurchases occurring after any number of days since the original purchase. We observe that it declines most dramatically in the days immediately following the first purchase.

For example, only about 32% of repurchases occurred 60 or more days after the previous purchase for this retailer. And by the way, only 22.5% of orders saw a repurchase 30 or more days after the transaction.

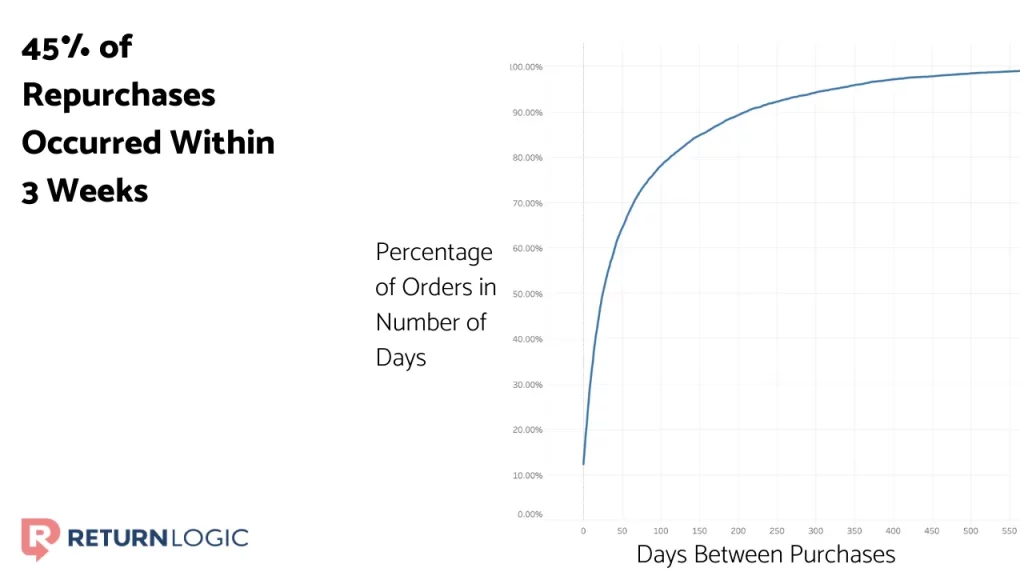

However, 45% of repurchases for this brand occurred within 3 weeks.

Once a transaction occurs, the clock to reengage is ticking.

All the information highlights the significance of reengaging customers fast. Even if they don’t buy again right away, they should be kept in mind.

How E-commerce Returns Impact a Customer’s Expected Monetary Contribution

Seemingly, repurchase behavior and CLV are tangential to a Shopify return management company. But anywhere between 20% and 50% of customers for a typical retailer have completed a return. It’s safe to say that returns are a standard part of the customer journey – and one that typically gets written off from a marketing perspective.

Fundamentally, e-commerce retail will never eliminate returns. They’re a natural process that you should instead seek to optimize.

Yet sadly, most retailers have no plan to reengage these hard-won customers during this natural phase in the e-commerce customer lifecycle.

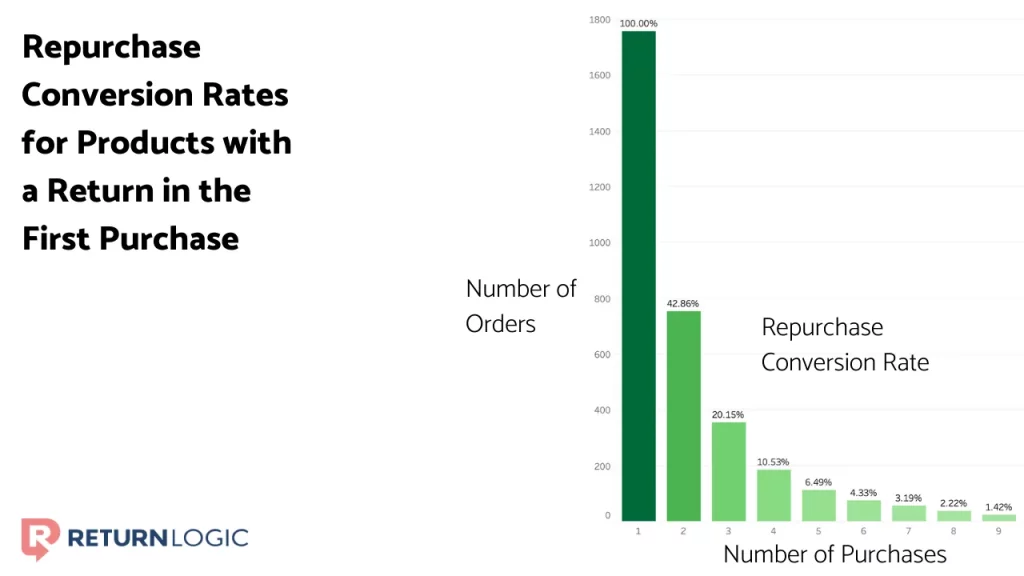

Just like other customers, retailers must continue to engage customers who return a product. By looking at first purchases that got returned, we can find the impact of a return on new customer relationships with a brand.

A returned first purchase doesn’t have a dramatic impact on repurchases in this case. It has slightly increased the likelihood of a second purchase for this retailer (partially due to exchanges).

This effect is gone by the 4th purchase when a higher percentage of customers who didn’t return their first purchase continued to buy.

Additionally, a return on the first purchase tends to stunt the expected monetary contribution of those customers. For the retailer we’ve been examining, the anticipated value of $331 for a customer whose first purchase resulted in a return is less than the $417 for customers whose first purchase didn’t.

That’s not to say the value of these customers will never catch up, but it didn’t over a year-long period.

For another retailer, the repurchase rate after a return in the first purchase never matched that of customers who didn’t do so.

This case illustrates that returns in a customer’s first purchase can have an appreciable impact on the monetary value a retailer can expect to gain. It all comes back to returns optimization.

Without the right strategies, it’s hard to recoup the investment in acquiring these customers.

We can also look at any order at any stage of that customer’s journey to see if it was returned and whether they purchased after. Knowing this will effectively approximate the impact a return has on repurchasing.

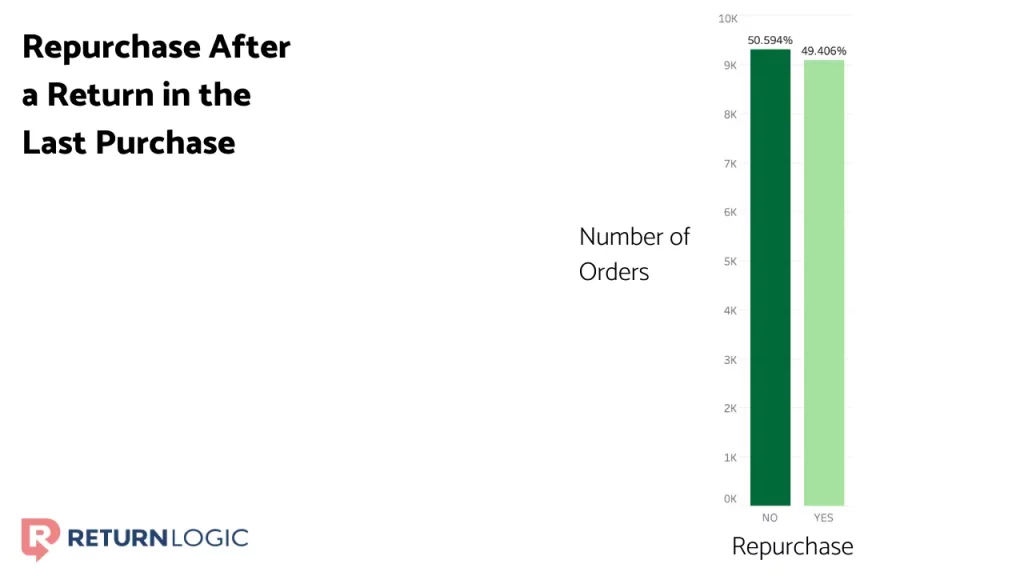

We see that among purchases made at least 3 months ago, slightly less than 50% have seen a repurchase.

Surprisingly, purchases with returns in this time frame exhibit a higher repurchase rate than others – though exchanges heavily inflate this since they inherently consist of a purchase.

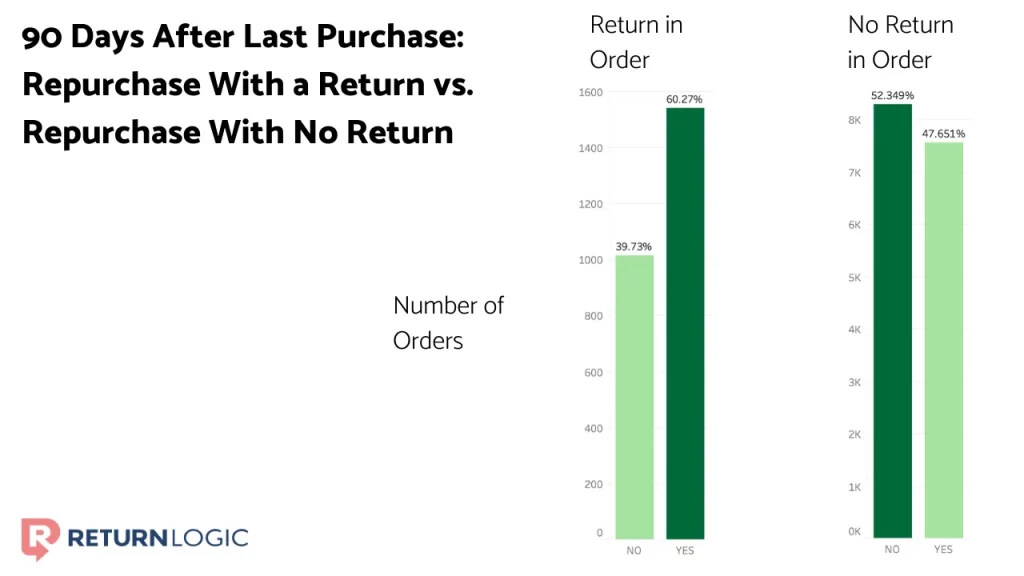

Exchanges have a near-perfect repurchase rate of 98.24%, while refunds have a repurchase rate of almost 50%. And returns for store credit, although they account for only around 100 cases, had a rate of repurchase of 81.18%.

We can further examine repurchase rate by return reasons. Return reasons allow us to understand why the customer is deciding to return an item.

We see that reasons related to sizing (i.e., “Too Big”, “Too Small”) have far less of an adverse impact on the likelihood of another purchase than other reasons; slightly more than half of all refunds with such reasons saw a repurchase.

Jake Pasini, Senior Director of Strategy Services at Listrak, explains:

“People who honestly select ‘too big’ or ‘too small’ are probably very interested in the item but just literally need to get a different size. Selecting ‘too big’ or ‘too small’ implies future purchase intent whereas ‘didn’t match description’ doesn’t – at least not to the same degree.”

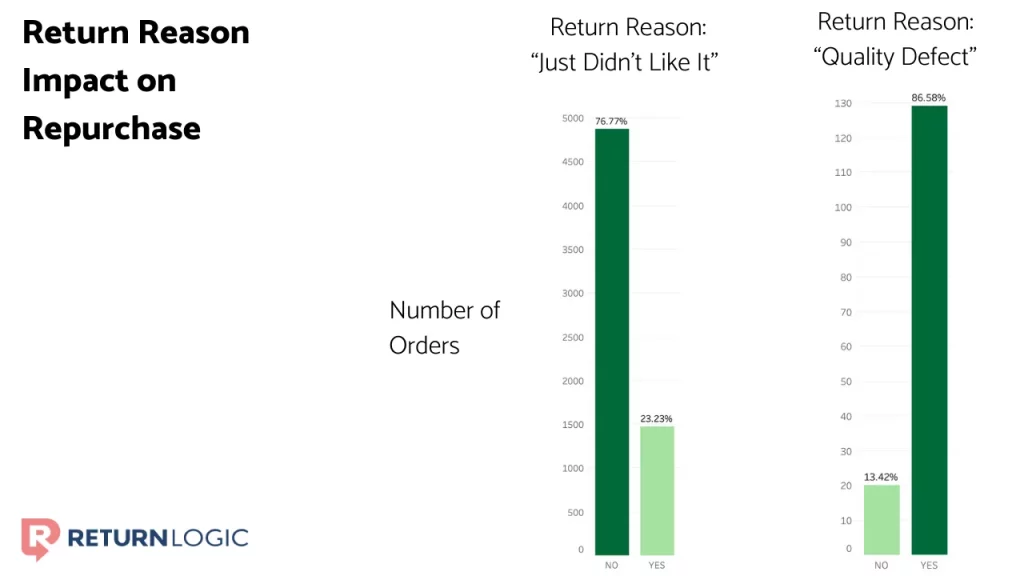

Product quality, on the other hand, seems to have a more significant impact on repurchases. Almost two-thirds of returns caused by quality issues hadn’t seen a purchase since.

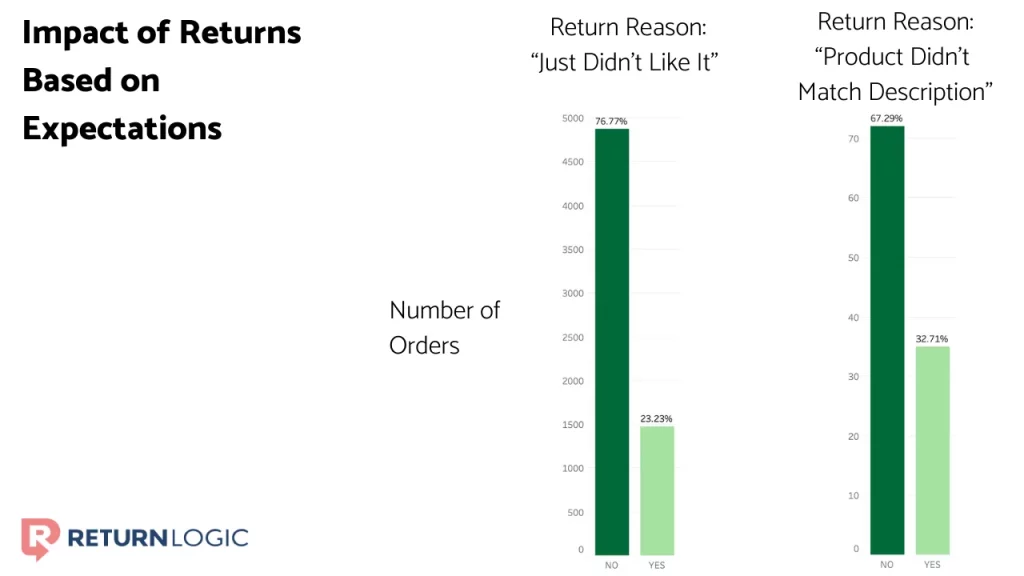

For another retailer, “Just Didn’t Like It” and “Product Didn’t Match Description” both jeopardized the customer relationship, as well.

While 73% of sizing returns saw repurchases, less than 25% of returns for “Just Didn’t Like It” and 33% of returns for “Product Didn’t Match Description” had repurchases.

Not even product damages or defects impact the rate of repurchase to this extent. Just over 80% of returns due to defects had a subsequent purchase. Though we can’t speak for customers, we hypothesize that this phenomenon is caused by the impact the return has on a customer’s trust in the brand.

Sizing issues are standard with clothing, and damages or defects frequently happen in some capacity. But they don’t reflect on the brand in the same way as product quality and description transparency.

Elysse Ciccone and Shannon Atwell of Noticed support this idea,

“Inconsistent measurements across brands help prime customers to forgive a mis-sized garment or two. But when your products don’t meet a customer’s expectations, you’re not just winning back their business – you’re winning back their trust.”

Because of this, it’s imperative to reengage the shopper who made the return – not just to save the purchase but to save the relationship.

Elysse and Shannon state, “When it comes to rebuilding trust, hands-on customer service is the most effective way to communicate. Personalized outreach goes a long way to show customers that you care.”

Next, you can look to address the underlying reasons for returns. Mr. Pasini articulates:

“If a statistically significant portion of reasons come back as ‘didn’t match description’ for a particular item, then that information needs to be reviewed by merchandising as there could actually be an issue.

The merchandising and UX teams need to know about ‘too small/big’ because improvements to product pages, content, or the sizing itself could be needed.”

Heavily edited photos and inconsistent descriptions across channels are common culprits. Elysse and Shannon recommend action shots, videos, and consistency to mitigate confusion and better align shopper expectations.

Maximize Customer Lifetime Value: The First Purchase is Just the Beginning

The biggest mistake a retailer can make is assuming that customer behavior is unchanging. Repurchases are not guaranteed, and acquisition doesn’t stop at the first purchase. As Michael Schrage stated, “The best investment you can make in measuring customer lifetime value is to make sure you’re investing in your customers’ lifetime value.”

We may never be able to perfectly define the true value of a customer. But, by understanding where value is coming from in the customer journey – or perhaps more importantly, where it’s not coming from – retailers can make informed decisions in their marketing processes.

According to Jake Pasini, “The key to any of these efforts is timing: they should be as soon to the return event as possible, every day and every hour will decrease the likelihood to purchase.”

The objective is to grow a more engaged customer base with less drop-off between purchases. At least in part, the value of a customer is up to the retailer.

Retention marketing is an enormous opportunity to grow revenue, and the path to repurchase begins at the prior purchase.

ReturnLogic partners with retailers to help them optimize their businesses. This optimization doesn’t stop at improving the return process or reducing return rate. We strive to advance retailers at any stage of business maturation.

The truth is, return management is a profit center.

Through return data analysis, we can find where to retain value in the customer journey. We can also identify points of natural activity by analyzing the customer journey to fuel retention marketing.